Hundreds of millions of dollars from Venezuelan oil sales are now sitting in accounts in Qatar. The move by the Trump administration has sparked attention, not only for its unusual route but also for the questions it raises about transparency and political intent.

While the funds could help Venezuela recover financially, their indirect path reveals the deep complexity behind international sanctions and diplomatic maneuvering.

Earlier this week, the Trump administration confirmed its first sale of Venezuelan oil, reporting an impressive $500 million raised. Officials said this is only the beginning of several planned sales that could eventually reach billions. However, instead of routing the funds through US banks or sending them straight to Venezuela, the money has been transferred to financial institutions in Qatar.

Former officials familiar with the decision said this approach aims to prevent creditors from claiming the funds. Treasury Secretary Scott Bessent stated that the money would begin flowing into Venezuela almost immediately.

Reports from local financial sources indicate that Venezuelan banks have started promoting available cash, a sign that the funds may already be reaching the country’s economy.

A Nation Cut Off from Global Banking

Instagram | @theep0shman | The Trump administration sold $500M in Venezuelan oil, routing the funds to Qatari banks.

Venezuela’s financial isolation is not new. Years of sanctions have severed its access to international banking systems, leaving the government scrambling to maintain liquidity. Over the decades, Venezuela’s leadership seized oil assets from foreign energy companies, triggering compensation claims that remain unresolved.

Former President Donald Trump has criticized Venezuela for “taking” American oil assets but has emphasized that revenues from these new oil sales must directly benefit the Venezuelan people. His executive order last week blocked any legal claims or garnishments that could interfere with these funds, arguing that such actions would disrupt efforts to restore Venezuela’s stability.

By placing the proceeds in Qatar, the administration aimed to protect the funds from international lawsuits while ensuring they serve their intended humanitarian purpose. This method also keeps the money away from creditors who have pursued Venezuela for years.

Why Qatar Became the Chosen Middle Ground

Qatar has long served as a diplomatic bridge between the United States and nations under sanctions. Experts note that this arrangement follows a pattern; Qatari banks have previously acted as intermediaries for restricted funds involving countries such as Iran during periods of eased sanctions.

According to Alejandro Grisanti, director of the Latin American consultancy Ecoanalitica, Qatari banks received clear instructions to auction the Venezuelan oil money to local banks. The process prioritizes essential sectors like food, medicine, and small business development. Once the funds are distributed, Venezuela’s Central Bank manages the allocation under US supervision.

Treasury Secretary Bessent confirmed that proceeds would support government operations, public safety, and basic provisions, emphasizing that the US wants to see tangible improvements in Venezuela’s living conditions.

Balancing Sanctions and Humanitarian Aid

The Trump administration faced a delicate balance, upholding sanctions against Venezuela’s authoritarian regime while addressing the severe humanitarian crisis. Millions of citizens have fled economic collapse, and those remaining face shortages of medicine, food, and electricity.

By channeling funds through Qatar, the administration can help sustain Venezuela’s essential sectors without directly empowering government figures accused of corruption or human rights abuses. However, this approach also leaves room for skepticism about who ultimately controls the money.

A senior foreign relations expert described Venezuela’s debt situation as “a web of obligations,” with creditors spread across multiple nations and industries. “The country owes nearly everyone,” the expert said. “This setup is the only way to prevent constant legal battles over every dollar.”

Rising Transparency Concerns

Despite the intended safeguards, the decision has drawn criticism for its lack of clarity. The expert warned that without a defined public plan, the setup risks becoming opaque. “If there isn’t a visible structure showing who controls the funds and how anti-corruption measures are enforced, it starts looking like a shadow account,” the expert said.

Critics argue that while there is no evidence of wrongdoing, secrecy could invite misuse. The worry centers on whether funds will genuinely aid citizens or sustain political loyalists and paramilitary groups that help maintain the current regime’s grip on power.

Opposition figures and global analysts are urging more accountability. They call for clear oversight mechanisms that confirm where the money goes and who benefits from it.

Political Reactions and Public Debate

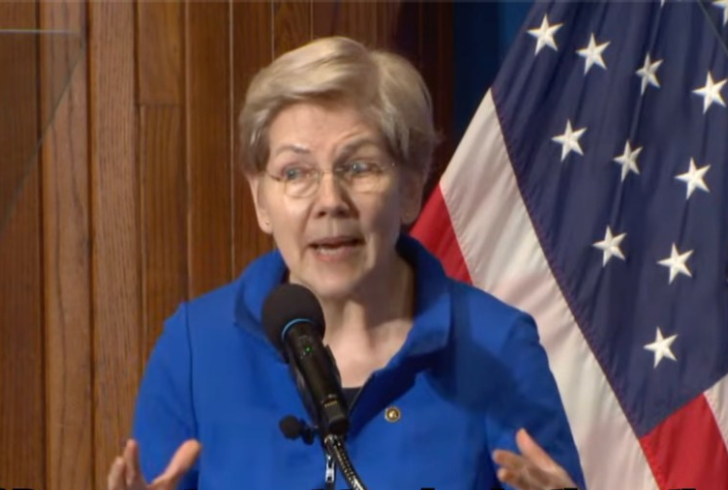

Instagram | @elizabethwarren | Senator Warren slams the president’s "unauthorized" transfer of seized assets to Qatar.

The move to send funds to Qatar has stirred political controversy in Washington. Senator Elizabeth Warren voiced strong objections, saying, “There’s no legal basis for a president to set up an offshore account under his control for seized assets. That’s the kind of action that raises serious ethical questions.”

Supporters of the administration defend the decision, arguing that bypassing traditional banking routes was the only realistic option. They point out that Venezuela’s frozen assets have long been entangled in lawsuits from global corporations and creditors. Routing the funds through Qatar shields them from seizure and accelerates humanitarian distribution.

Still, many observers question whether this structure can remain transparent enough to avoid political exploitation. The lack of public documentation on how the funds are monitored leaves both economists and policymakers uneasy.

A Test of Trust and Diplomacy

This decision marks a defining moment for how sanctioned nations might receive aid in the future. If the Qatar model proves effective, it could become a template for handling restricted funds tied to unstable governments, while also highlighting the executive branch’s power over international financial flows.

For Venezuela, the stakes are high. Years of economic collapse, hyperinflation, and political turmoil mean any new funds could bring hope—or risk. If managed well, the money could stabilize parts of the economy and provide relief to millions; if not, it might deepen mistrust and corruption.

The decision underscores the collision of politics, economics, and humanitarian goals, showcasing a form of financial diplomacy that protects assets while demanding public trust. How responsibly both nations handle this process will determine whether the funds bring stability or provoke further tension.